An Intro to the Profit First System for Online Business Owners

What would you say to a system that guarantees your business will turn a profit, save for taxes, pay your expenses, and pay YOU?! The correct answer is “Uhm, where do I sign up!?”

Even when I was an accountant, I’m not sure I would have believed such a system was possible. But the magic unicorn is real, ya’ll. And it’s honestly so simple.

What is Profit First?

Profit First is a system (and a great book!) from small business finance expert Mike Michalowicz.

Profit First is based on the idea that we need to allocate our income and prioritize our profit before paying any of our expenses.

Typically, we take our income, subtract our expenses, and call the leftover profit (if we’re lucky enough to have any).

Income - Expenses = Profit

Mike suggests we flip the script. We take our income, prioritize a percentage for profit, and take whatever’s left and use that to pay our expenses. If there’s not enough, we have too many expenses and need to make cuts. With the right commitment, this system guarantees profit.

Income - Profit = Expenses

The Profit First Accounts

And it’s not just profit. Mike offers recommended allocation percentages across four total accounts - literally, he says to open five separate bank accounts for each category! (Did that just freak you out? No worries, I’ve got a potential bank account alternative for you later on!)

All of your income is going to be deposited into your Income account. Then, on the 10th and 25th of each month, you’ll make your allocations. (Though, I personally allocate weekly, not twice a month.)

You’ll allocate a percentage to your Profit account, which will act as a cash-cushion/rainy-day fund as well as a quarterly source of profit distributions for you, the owner!

You’ll allocate a percentage to your Owner’s Compensation account, which will be the fund that you take from to pay yourself your salary. And you should always be paying yourself a salary!

You’ll allocate a percentage for Tax savings so that the government always gets its money!

And finally, a percentage will go into the Operating Expense account, which is where all of your expenses come from. What you see in this account is what you have to work with.

It’s not unlike the traditional Cash Envelope system that you may have heard of. Someone following the Cash Envelope system takes their pay, cashes it out, and distributes it to various envelopes labeled for different purposes: Groceries, Gas, Clothes, Utilities, Rent, etc. When the envelope is empty, the money has run out for that category. The only way to spend more is to pull from another envelope.

Having multiple bank accounts is the digital version of this system, and it works just as well! In fact, with everything in business being online these days, I’d venture to say it works better.

The key is to have the discipline to not steal from your other accounts. Once the money is allocated, there are few-to-no reasons to move the money around again.

(Pretty confident you’re disciplined enough to not need these separate bank accounts? Hang in there! I’ll get to you!)

This is why Mike also recommends taking it a step further by creating second versions of the Profit and Tax accounts at an entirely separate bank. You’ll move the original funds from the first Profit and Tax accounts completely out of sight, out of mind. Personally, I don’t quite see this as a necessity, but if you think it’ll help remove the temptation (he calls them the No Temptation accounts), by all means!

Why the Profit First System Works

When you work with a system like this, you’re making sure that, no matter what, your business is acting as it should. You’re designating funds so that all aspects of business are being covered, not just your regular expenses.

When you spend all the money in your bank account on expenses, you’re robbing your business (profit), yourself (compensation), and the government (tax).

Many people will probably be averse to the idea of forcing their expenses that way, but it’s really a necessity. If you’ve allocated all the necessities (profit, comp, tax) and don’t have enough leftover for your expenses, you can’t afford what you’re paying for. That’s a sign that your business is suffocating, and you’ll need to cut the expenses until your income can meet those demands.

Between the simplicity and the visual nature of everything, Mike’s system combines both the math and human behavior related to finance to create a system that’s honestly a guaranteed win! If you’re 100% committed, you’ll be 100% successful.

(Obviously, you have to actually make money for this to work, but I figure that’s a given.)

P.S. If you’re a fan of Dave Ramsey’s personal finance teachings, you’ll like this system. They’re both working with those same core beliefs about human nature and money! Mike even recommends the Debt Snowball for abolishing business debt.

Do I need the bank accounts?

This answer depends on you.

If you’re the kind of person that tends to justify poor spending decisions to yourself over and over again, I’d venture to say that you need the physical separation of your funds.

However, if you can commit to following a written plan for your spending decisions (versus just checking your bank account balance), there are a few alternatives.

>> Profit First Alternative #1: BANK SUB-ACCOUNTS

A somewhat less tedious yet still valuable banking option may be sub-accounts if your bank offers this or you don’t mind making a switch.

Sub-accounts are smaller accounts nested under the main umbrella of your primary account.

For example, if you have $10,000 in a savings account but that account houses two separate funds, you may want to create two sub-accounts: one for a $6,000 car fund and the other $4,000 designated for general emergencies.

Because savings accounts have limits on how many withdrawals you can make, it’s best for your Operating Expense account (and potentially your Income account) to be a checking account. The rest of your Profit First funds are less frequently utilized and can be savings accounts. That said, I do think some banks out there offer sub-account features for checking accounts!

This is a more modern banking feature and is more likely to be found in online-only banks. Some US-based banks I’ve found that seem to offer sub-account functionality are Relay (the official banking platform for Profit First, actually!), Capital One 360, Ally, Barclays, Betterment, or Wealthfront. Note: Please do your own research into banking solutions that will meet your needs!

>> Profit First Alternative #2: You Need a Budget (YNAB)

You Need A Budget (YNAB) is the only budgeting program that I would recommend to implement Profit First and not utilize the bank accounts. Why? Because YNAB follows a very strict method of budgeting the cash currently in your bank (not planning around projected income). This essentially acts as a virtual cash envelope system in and of itself, which is exactly what Profit First’s bank accounts are for!

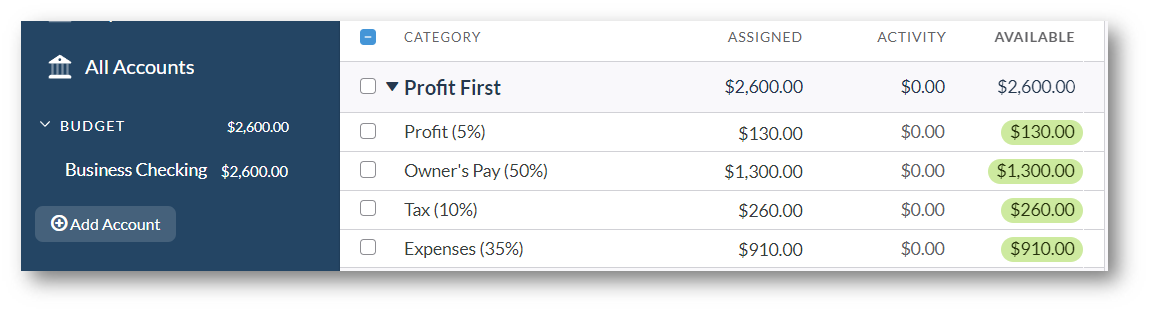

While I have $2,600 in the bank in this example, YNAB shows me that $130 is my cash reserves for profit, $1,300 is designated for my next paycheck, $260 is saved for taxes next year, and $910 is left over for my business expenses.

In my opinion, this is the absolute best way to follow Profit First without as much hassle with the bank accounts. It’s how I manage my own finances, and I’ve done so this way for years. The flexibility of the tool makes it a perfect match for my more forgiving approach to budgeting.

(Re-read that as: When reality hits, my budget bends, it doesn’t break. 😉)

>> Profit First Alternative #3: The SIMPLE Profit First Tracker

Here’s a unique one! If YNAB feels like too much of a commitment for you right now, or you simply don’t want to pay the subscription just yet, then I’ve created a spreadsheet resource that acts as a stripped-down Profit First budget alternative.

This tool is set up very carefully to allow you to track all of your money into and out of your Profit First accounts. It even keeps track of your current available balances inside each of the accounts and allows you to reconcile with your total bank balance (ensuring that the numbers you see are accurate representations of how much money you actually have).

It’s extremely important that the math and functionality of a Profit First spreadsheet is done correctly. Profit First only works if you’re making real allocations of real dollar amounts, and then sticking to those balances without stealing from your own funds. If your spreadsheet isn’t up-to-date and accurate, the whole system falls apart.

And the good news is, this spreadsheet comes as a part of a bundle!

How do I start Profit First?

>> Step 1: Learn The Full System

My first recommendation is to spend more time learning the full Profit First system. This blog post is an introduction, but I certainly didn’t cover everything!

You can definitely choose to read Mike Michalowicz’s book for yourself. He’s hilarious and offers very thorough and easy-to-understand explanations for the nuances of his system.

With that said, the book is targeted a bit more at traditional business models and a lot of it may not be as applicable for online entrepreneurs and solopreneurs. Plus, finance books may not be your thing, and I get it. 😉

That’s why I created my course, The Profit First Blueprint for Online Businesses. In five value-packed lessons, you can learn how to revolutionize your online business's financial game with the Profit First system — including how to customize it to your own needs if the “traditional” way isn’t your cup of tea.

>> Step 2: Determine Your Percentages

Another common question is, What percentages do I use for my allocations?

The most important thing is to know your numbers and set your percentage allocations to be realistic and attainable for your current circumstances. Then, every quarter, you can adjust little by little towards your ideal percentages.

Fortunately, this is ALSO a resource inside of the free CFO Starter Kit to help you determine the best allocations for your business's current state and future “ideal” state. Yes, the Kit is really worth checking out. 🤑

>> Step 3: Determine Your “Fund” Method

Bank accounts, sub-accounts, YNAB, or the One Bank Account Profit First spreadsheet? Take your pick and give it a try! Commit to that system for at least one month.

Schedule in advance when you’re going to update your financials and do your Income allocations. Whether you follow the 10th & 25th method or set a specific day each week (my recommendation), it’s important to make this as important as a client meeting in your schedule!

>> Step 4: Make Your First Allocation

Take your starting bank balance and treat it as income. Make your first allocation with your chosen percentages, and then ask yourself if the amount you have reserved for Operating Expenses is enough to hold you over until your next cash inflow. If not, you may have to pull some cash from another fund (or transfer some in from your personal account if you’re able). It’s okay for this to be a transition you take in baby steps! As long as you understand that the goal is to be able to maintain your Profit First funds in full ASAP.

Remember: Profit is not a nice-to-have, it’s a non-negotiable.

Are you ready to take your financial journey to the next level? Then you may be ready to check out the More With Money Academy!

This ever-growing collection of online courses and trainings are specially designed to support entrepreneurs like you on your path to financial wellness. The Academy contains carefully designed courses that are easy to understand and implement so that you can be empowered with the practical concepts, streamlined systems, and powerful mindset to transform your business and personal finances.

Click here to explore what the More With Money Academy has to offer!

Until next time!